LEVEL FOUR

Budget Like You’re Building a House

For most of us, budgeting is right up there with going to the dentist, doing taxes, and standing in line at the DMV. It’s one of those things you know you have to do at some point, and it wouldn’t be that big of a deal except for the fact that it’s also the worst thing in the world, so you avoid it. But at some point, reality sets in and you have to clean your teeth, renew your license, and, yes, build a budget.

Part of the reason budgeting is a nightmare for most people is that budgets rarely work. We always find a way to destroy them. They’re impossible to stick with. They’re restrictive. We make budgets to control our spending, but our spending always seems to win, which is why some people don’t bother budgeting at all. They figure their spending is what it is, convince themselves they’re too broke to do things they really want to do, like travel more or move to a bigger place, but in reality, they don’t know if that’s true or not because they don’t even know where their money goes every month. I used to be terrible at budgeting, too. My budgeting process went something like this: set random limits on my spending, try not to spend so much, check my bank account two weeks later only to discover I’d overspent on everything, rendering my “budget” useless, repeat.

Most of us think of our budgets like a mean boss, someone who is there to tell us what we should and shouldn’t do with our money. It’s a lot easier to stick to a budget that works for you instead. Rather than make a budget that’s a set of rules to restrict yourself, we’re going to make a plan for the mission you established in Level One. The budget you’ll have created by the end of this level will be designed to support your goals and work for you.

It’s a little corny, and maybe I’ve watched too much HGTV, but a budget is a lot like a house. You have to live with it every single day of your life, so you better make sure it’s built to last and doesn’t fall apart on you. That means starting with a solid foundation and then laying out the construction meticulously. With that in mind, let’s start building.

LAY THE FOUNDATION (WRITE DOWN YOUR MISSION)

If you’re budgeting because you’re twenty-seven and it’s time to be a grown-up, that foundation might hold you over for a couple of weeks, but eventually, a piña colada will ruin you. You’ll be out with your friends and one of them will order a delicious, milky, boozy coconut drink. Yes, it’s $14, but when was the last time I had a piña colada? It’s been way too long. I work my ass off, and I deserve this. Budget? Life is too short to budget!

Honestly, you wouldn’t even be wrong for this. I can only speak for myself, but when given the choice between adulthood and a fruity alcoholic beverage, fruity alcoholic beverage wins every time.

A durable house needs a solid foundation, and so does a durable budget. In this case, your foundation should be your mission, or why you want to budget in the first place. If your purpose is simply to be a responsible adult, that’s a weak foundation. You’re most certainly setting up your budget to crumble down the road.

When your budget has a real purpose, though, it changes everything. Next time you’re tempted to spend your money on a fruity beverage, you now have a choice to make. Chances are, you’re going to choose the thing that matters to you more, whether it’s an epic trip, a college savings plan for your kid, or just the freedom of not being in debt. All those things are better than a fruity beverage, but in order to make the choice, you have to lay it down as the foundation for your budget.

The good news is, you’ve already done this in Level One. In fact, your mission isn’t just the foundation for your new budget, it’s the foundation for this entire book! With your Level One mission in mind, fill in the blank:

I want to create a budget and get my money in order because:

PRO TALK: Erin Lowry, Author of Broke Millennial

WHAT’S THE FIRST STEP IN GETTING YOUR FINANCIAL LIFE TOGETHER?

The first step is knowing your cash flow. You cannot make any informed decisions without knowing exactly how much money is coming in each month and how much is going out. This means facing and knowing your debt down to the penny. It also means setting financial goals and then making tough cuts in order to achieve them.

BUILD THE FRAME (LIST YOUR EXPENSES)

Once you’ve laid the foundation, the next step is building the framework for your budget, the skeleton around which everything else is built. In other words, let’s define some spending categories. Grab a sheet of paper or use the template here at the end of this level (or at www.TheGetMoneyBook.com), to follow along. Go ahead, I’ll wait. At the top of the paper, write down* your average monthly income after taxes. You’re about to make a list of all the things you spend money on, so take a minute to log in to your bank accounts, pull up your credit card statements, or, if you live in 1995, find your check ledger. Just make sure all your monthly spending is laid out in front of you.

List Your Needs

From here, write down every expense that counts as a necessity—something that would be actually hard to live without, like rent, electricity, or groceries. No, that $5 bottle of Icelandic glacier water filtered with fairy tears you get at Whole Foods probably isn’t a necessity, but you do need groceries, so just add it to the list for now. We’ll get to cutting back later.

While you’re looking for necessities, don’t forget about your irregular expenses, too, like car registration. Divide that annual expense monthly (that is, by 12), and add it to the list. Here are a few other irregular expenses people usually forget about:

Car insurance premiums

Car insurance premiums

Holiday spending

Holiday spending

Predictable pet bills, like

vaccinations

Predictable pet bills, like

vaccinations

Oil changes and other car

maintenance

Oil changes and other car

maintenance

Home repair projects

Home repair projects

Find Your “Everything Else” Amount

Once you’ve listed all your needs and how much you spend on them every month, grab your calculator and add everything up. Then subtract this number from your monthly income. Write down this amount—it’s the money you have left over for everything else: debt payments, savings goals, retirement contributions, and, of course, discretionary spending.

List Your Goals

Most people budget their spending haphazardly and tell themselves they’ll put whatever they have left over after spending toward their goals. The problem is, there’s usually nothing left over, because we always find a way to spend that money. It’s important to include a category for these goals in your budget because that way, you’ll actually prioritize them.

You might want to pay off a credit card debt, get out of student loan debt, save for retirement, or save for a down payment on a home. Whatever your goal(s), write it down as a category under your necessities. If you’re using the template here, you’ll see a spot for this.

List Your Wants

Discretionary spending is a fancy word for “wants.” These are all the expenses you probably don’t need for survival, but they sure do make survival nice: new clothes, your Netflix subscription, candles from Target. Your categories might be general and look something like this:

Restaurants: $500

Entertainment: $100

Home goods: $30

Or they might be more specific and look something like this:

Restaurants: Fast food: $50

Entertainment: Netflix: $10

Home Goods: Air fresheners: $10

Restaurants: Bars: $100

Entertainment: Movies: $20

Home Goods: Cleaning supplies: $10

Restaurants: Weekend dinners: $200

Entertainment: Concerts: $75

Home Goods: Candles: $10

Restaurants: Takeout: $150

It’s up to you to decide how specific you want to be with your categories. Some people prefer to keep their budget simple so it’s easier to stick with. Personally, I like to drill down, particularly when I’m focused on cutting back on a certain area. For example, if I want to curb my fast-food spending (McDonald’s fries are my weakness), I’ll create a category for that, separate from restaurant spending. General or specific, write down these categories under your financial goals. Again, the template here has a space for you to do just that.

At this point, you should have a full list of all your spending categories, divided into three groups: basic living expenses, financial goals, and wants. Just to be clear: yes, Target candles are “wants.”

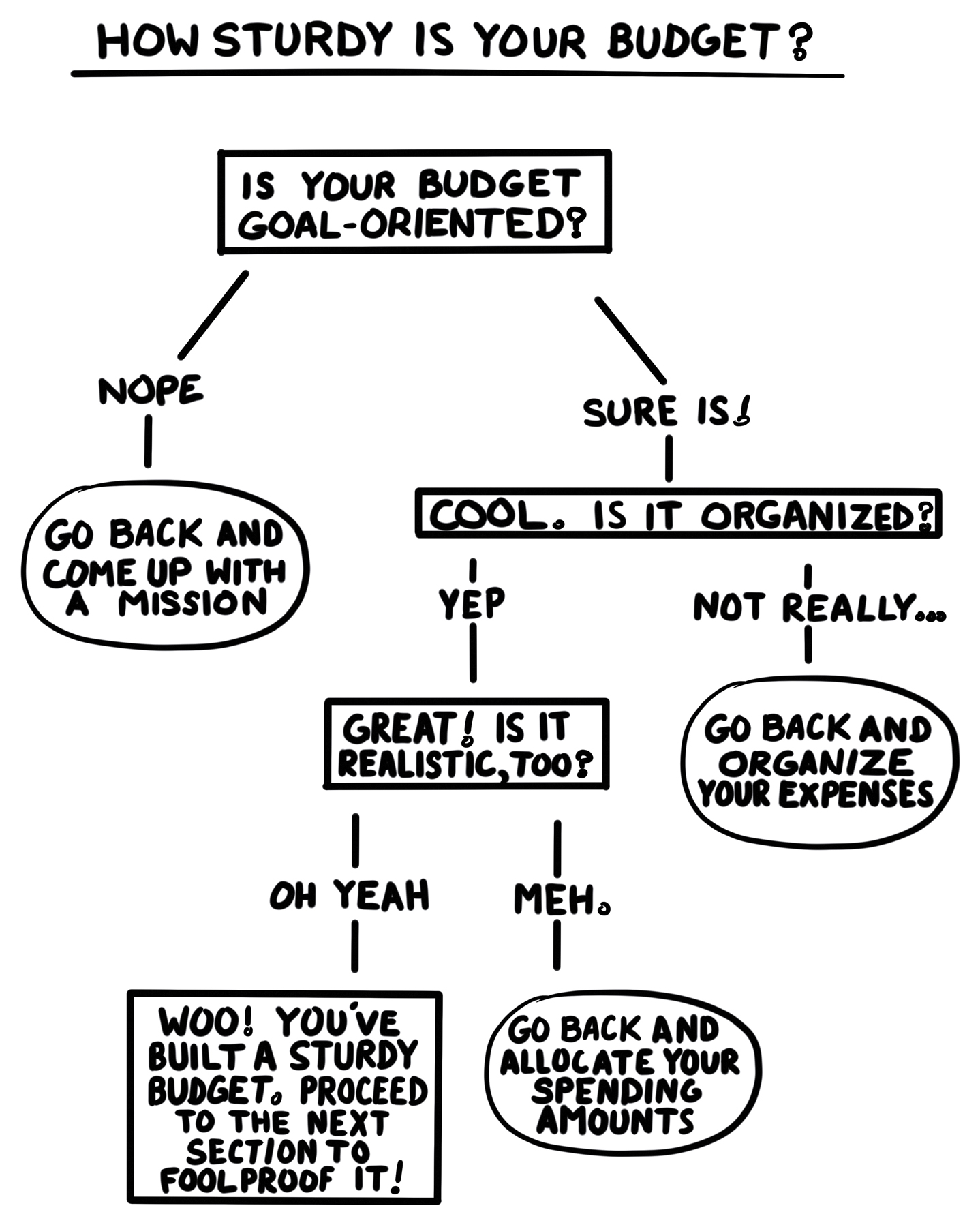

START BUILDING (ALLOCATE YOUR SPENDING)

You’ve built the framework—now it’s time to actually build. In terms of your budget, that means it’s time to calculate how much you’re going to spend in each of the categories you’ve established.

Remember the “Everything Else” amount? Start with that and decide how much you want to allocate toward your financial goals. If you need a ballpark rule, consider setting aside 20 percent of this amount toward your goals. If that’s too much or too little for your liking, you can adjust later in this step.

Once you decide how much you want to allocate toward your goals, subtract that amount from your “Everything Else” amount. This is the amount you have to spend on your “Wants.” Grab your calculator again and add up your actual spending in each category. Decide how much you want to spend on everything, based on how much you can afford and how much you actually spend. This way, your budget is based on your goal, but it’s also realistic: based on your actual spending.

What If I Don’t Have Enough?

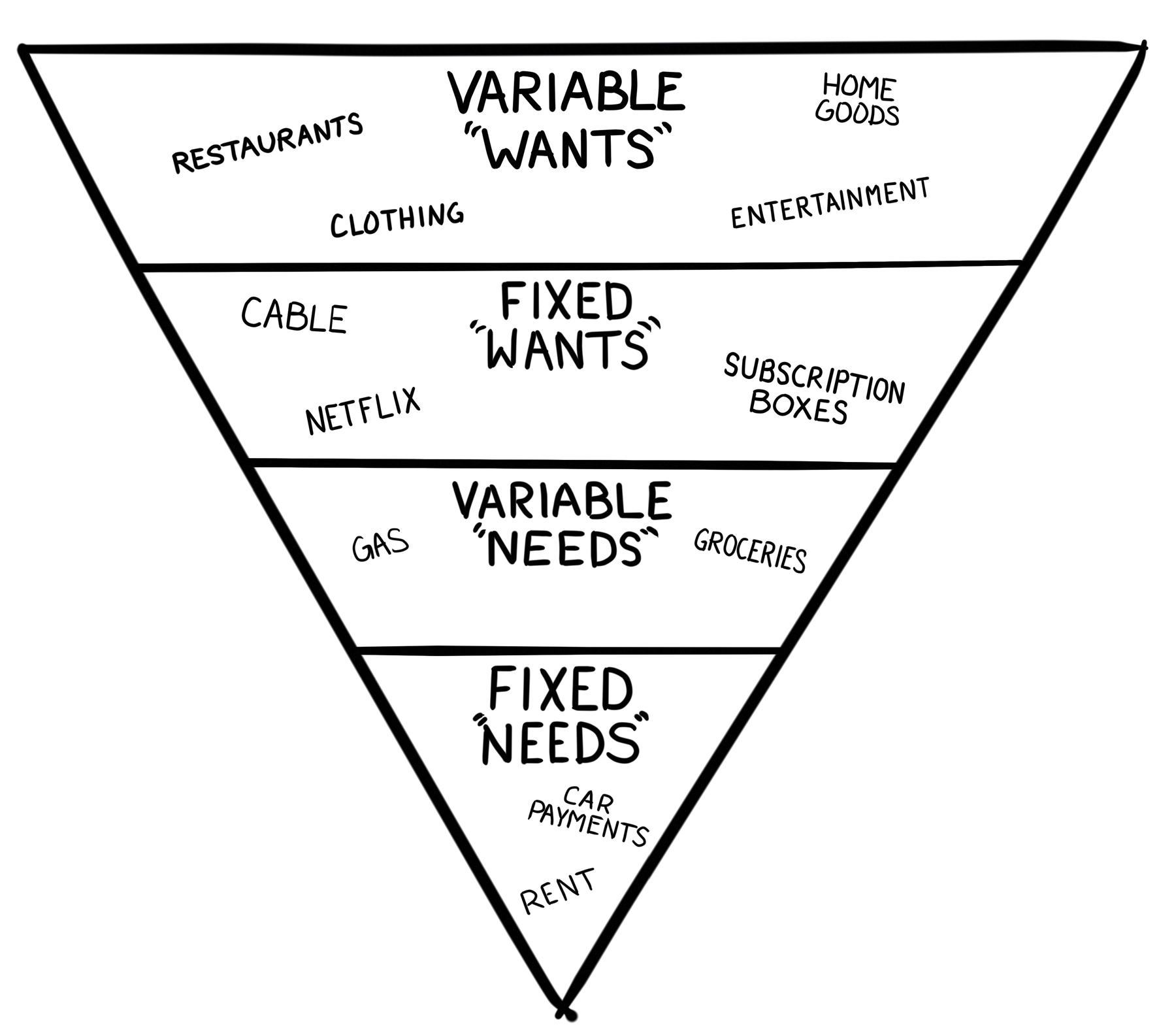

Let’s say you’ve prioritized your discretionary spending but the issue is, well, you just don’t have enough money to cover everything. Where do you start when it comes to cutting back? It’s impossible to tell you what you should cut back on without looking at your spending (personal finance is personal, after all). That said, since you divided your wants from your basic living expenses, it will be easier to figure out what to cut back on first in order to allocate more for your goals. When looking for ways to trim your budget, consider the “Where Do I Cut Back?” inverted pyramid.

According to the pyramid, the first place you should look to cut costs are your variable wants. These are expenses you don’t need to survive and that also vary from month to month: restaurants, clothing, makeup, and home goods, for example. These are the easiest expenses to be frugal with because you can simply spend less on them without sacrificing them entirely. Again, you want to cut back gradually and realistically, so start with a little at a time, and focus on one variable expense at a time.

Still not enough? Then target your fixed wants: the nonessential expenses that cost the same amount every month, like cable TV (there’s life beyond House Hunters, I promise), magazine subscriptions, or gym memberships. You can survive without these expenses, but once you give them up, they’ll be gone entirely.

If you’ve cut your wants as much as you realistically can, you’ll have to examine your variable needs: groceries, gas, or your electric bill. Is there any way you can cut costs in these areas? It might mean carpooling or buying generic or turning off the air-conditioning more often. Cuts in this area require a little more sacrifice.

Finally, your fixed needs are last-resort expenses you can try to cut if you’re really desperate. There’s your rent, for example. Can you move to a cheaper apartment? It’s also car payments or registration. Can you get rid of your car and bike to work or take public transportation instead? Again, these are the least ideal cuts you can make, but if you really want to find more money in your budget after exhausting the other areas, you should ask yourself whether these cuts are worth it. Maybe they’re not. But maybe desperate times may call for desperate action.

PICK A TOOL TO TRACK YOUR PROGRESS

Once you have a plan in place for your budget, you need an actual system to track that plan. It’s easy enough to track your expenses with a spreadsheet, and both Google Spreadsheets and Microsoft Excel come with budgeting templates to help you get started. To use each one, manually plug in your spending each week, then let the spreadsheet’s formulas calculate everything for you so you can keep track of it all.

Online apps and tools make it even easier to track and organize your spending. Link your accounts and the app will do the work for you. There’s very little maintenance involved. Here are a few popular options.

Mint.com (Free)

Best if: You want an easy, all-in-one financial plan that still allows for customization.

How it works: Mint is probably the best tool if you want to automate your budget. It’s free and mostly web-based, although it does come with a free app for iPhone, Android, and Windows Phone. To get started with it, link your financial accounts, from checking accounts to retirement funds to credit cards. (This can be scary, but Mint uses multifactor authentication and encryption to keep your data safe, just like your bank.) Then set up your budget, including spending amounts in each category, and Mint will track everything for you all month long. If you come close to reaching your spending limit, they can even send you alerts via e-mail. You can create rules for certain expenses, too. For example, if you write a check for rent every month, you can create a rule to always categorize checks in that specific amount as “Rent.” Beyond tracking your basic household budget, Mint will also track your goals, credit score, and investments.

You Need a Budget or YNAB ($5/month or $50/year)

Best if: You want to track every penny and need motivation to stick with your budget.

How it works: You Need a Budget is a very hands-on option that helps you track every cent of your spending. It has a strong, active online community in the form of a blog and forums where you can get support, talk about money, and ask questions. It’s best if you want to budget meticulously, but that means you have to manually add your transactions every day. If you don’t keep up with it, it won’t work very well. You download the actual software to use it on your desktop (it’s available for both Windows and OSX), but they also have mobile versions for iOS and Android. Like Mint, YNAB imports transactions from your bank accounts, investments, credit cards, and loans to track your finances. Also like Mint, they use encryption to keep your data safe (and have plans to add two-factor authentication).

BudgetSimple (Free)

Best if: You have zero experience creating a budget or your budgets always fail.

How it works: As its name suggests, BudgetSimple is a free budgeting tool that makes budgeting super simple. It analyzes your spending habits, then generates a budget plan with suggestions for how you can cut back and how you can increase your savings. The tool’s overall goal is to help you break the paycheck-to-paycheck cycle. It promises to help you understand your finances better and figure out where to save in an hour. With the free version, you manually enter your transactions. You can link your bank accounts and do it automatically, but that costs $4.99 a month. The basic plan is free and gives you access to the web app online. If you pay the $4.99 a month, you also get access to the mobile version. Overall, it’s straightforward, simple, and does a good job of helping you set up a budget. Again, your data is encrypted, and BudgetSimple uses two-factor authentication to safeguard your data.

Whichever budgeting tool you choose—whether it’s an app or a spreadsheet you maintain on your own—that tool should help you track your plan so you always know where your money goes.

GET MONEY CHALLENGE #2: Stop Splurging

Remember the spending weaknesses you listed in the previous section? Pick one of them. Vow to eliminate this expense completely for a month. Maybe it’s gadgets, Amazon goodies, or shoes. Whatever the splurge, challenge yourself to cut back for the next four weeks. Then share your success on social media with #GetMoneyChallenge.

MAKE YOUR BUDGET FOOLPROOF

You’ve heard the phrase, “Pay yourself first,” right? The idea is that when you get paid, the first thing you should do is fund your financial goal, whether the goal is to save up for a new car or pay off your credit card debt. “Pay yourself first” makes it easy to stick to your financial goal because you fund it as soon as you get paid, before you even have a chance to spend it. In practice, this might mean you schedule an automatic credit card payment on the day you get paid (or they day after, in case of any payroll hiccups). It might mean setting up an automatic transfer from your checking account to your savings on the day you get paid. Resist the temptation to spend “extra” money in your account. There is no extra money! It’s already been spent on your goal. Paying yourself first is just one smart way to protect your budget. Here are a few others:

Save a healthy emergency fund: An emergency fund goes hand in hand with a successful budget. If you don’t already have an emergency fund, that should be your financial goal. Revisit Level Two.

Keep a checking account cushion: For those extra expenses that pop up but aren’t exactly emergencies, it helps to keep a little cushion in your checking account. As my dad used to say, “Make $1,000 your new zero.” In other words, aim to always have an extra amount on hand. If $1,000 is too high for you, start with a $100 cushion or even a $25 cushion.

Use overdraft protection: In case you do overspend (or maybe you just underestimated your expenses), make sure you’ve taken advantage of your bank’s overdraft protection feature so you’re at least not racking up overdraft charges. You’ll have help picking a bank that offers this feature in Level Six.

If you pay yourself first and stick to your budget, the only reason you’ll have to monitor your budget is to stay on track and ensure there’s no fraudulent activity on your account. (And you should definitely do this. Thanks, Equifax.) It’s important to adjust your budget every now and then, too. If you get a raise or a pay cut, for example, it’s time to give your budget another look. Overall, though, with these steps, you’ll have a solid budgeting system that doesn’t even require a lot of active management on your part.

HOW TO BUDGET WITH AN IRREGULAR INCOME

Oh, they joys of irregular income. Budgeting can be tricky when your income varies from month to month. If you’re paid $1,000 one month and $5,000 the next, how do you know if you have enough to cover your regular monthly expenses? If your income jumps around a lot, chances are it’s because you’re a freelancer or independent contractor. As a freelancer myself, there are a few financial moves I wish I would’ve made sooner:

Build an even bigger emergency fund: Unexpected expenses seem to arise more frequently when you’re a freelancer, whether it’s an extra business expense, higher-than-anticipated taxes, or just the cost of losing a client. During my first year freelancing, I actually depleted my emergency fund because I was unprepared for how much I’d have to pay in taxes (I’ll tell you all about that in Level Ten). A good rule of thumb to remedy this? Save even more than you normally would for an emergency—some experts recommend doubling your emergency fund.

Save for taxes: When you’re a freelancer, you have to submit your own taxes to the IRS throughout the year. These are called estimated quarterly taxes and you can pay them online through the IRS Direct Pay tool. Don’t forget to set aside a percentage of your freelance income to cover these taxes. This comes as a big, unpleasant surprise for too many freelancers.

Keep a cushion for business expenses: Set aside a cushion for certain business expenses, like software or courses, so you can hone some skills. If you’re a freelancer, you’re probably trying to find more clients and increase your income, and sometimes that means investing in yourself as a business. If you have money set aside for these expenses, you won’t feel guilty about spending it.

Separate Your Business and Personal Finances

If you’re a freelancer, at some point you’ll want to separate your business and personal finances. It can be complicated, but there are a handful of benefits to separating. For one, you can pay for business expenses or subcontractors from your business account instead of disrupting your own personal budget. Second, separating makes it a lot easier to keep track of tax deductions. Pay for all your business expenses with a separate credit card or bank account, and when it comes time to do your taxes, you’ll have all those expenses in one place. Budgeting is also easier because you can pay yourself a set income from your business account, which is one way to get around the irregular income problem. Separating my business and personal accounts made it easier to organize everything, but I had to come up with a system to make it all work. I’ll share with you the system and bank accounts I use for my own freelancing business:

Business checking: My main account where I receive client payments and pay for business expenses, like office supplies or virtual assistance.

Business savings: I use this account to save for taxes. If I have anything extra left over after paying these taxes (a gal can dream), I save it in my SEP-IRA (Self-Employed Individual Retirement Account).

SEP-IRA: An account that allows me to save extra for retirement if I max out my personal Individual Retirement Account. Don’t know what that is? That’s OK, you’ll learn more about this in Level Eleven.

Personal checking: This is my personal checking account that I use for mortgage, bills, and any other non-business expenses. Each month I pay myself a “salary” from my business checking account and deposit it into this account.

Personal savings: Finally, my personal savings account serves as my emergency fund. I never touch it unless there’s an emergency.

Some banks offer business accounts that are strictly for LLCs (limited liability corporations) or individuals with a DBA (doing business as) license. However, you don’t need an official business account for your freelance or self-employed expenses if you’re not an LLC or DBA. You can just as easily use a non-business account for these expenses.

Pay Yourself a Salary

The easiest way to budget with irregular income is to pay yourself a regular salary. Set up a recurring monthly payment (or biweekly payment, if you prefer) from your business account to your personal checking account. It’s like getting a paycheck from a regular employer, only you’re the employer. But first, you have to figure out how much your paycheck should be, and the first number to look at in order to determine that is your average income.

My income has been pretty steady for the past year, so my “paycheck” is based on my average income for the past twelve months. If your own income jumps around, you might want to adjust your numbers. If your income has been much lower lately, you may want to base your average on the past few months, for instance, then adjust more frequently. As a self-employed person, you don’t have an employer to help you save extra for retirement, set aside money for taxes, or pay your health insurance. Before you decide how much to pay yourself, don’t forget to factor in all these fun overhead costs and any others you need to run your business.

Once you have a reasonable idea of what your average monthly income is after these expenses, decide how frequently you want to be paid: weekly, biweekly, or monthly. During months when your freelance income is higher than average, you’ll have money left over in your business account after paying yourself. During months when your income is lower, you’ll draw from that leftover money when your “paycheck” to yourself goes through. This isn’t a completely hands-off system. You’ll want to adjust every so often, depending on how much your income fluctuates. Unfortunately, irregular income budgeting does require a little more attention, so fine-tune as necessary, especially if your average income changes.

BUDGET TROUBLESHOOTING

Let’s be honest. Even with a solid mission, a budget can get tiresome. When you’re excited about your new habits and goals, you’re more motivated to stick to your plan. Then it gets old. You get tired of giving up sushi night. Dammit, life is short. You want your sashimi. So you forget about your mission, like getting out of debt or buying a home someday. How are you ever going to save for a down payment if you keep getting distracted with tuna hand rolls and sake shots?

If you’ve crunched the numbers, categorized all your spending, and still can’t seem to stick to your budget, here are a few solutions that can help you fix it, depending on the problem you keep facing.

Problem: I cut my spending to zero but I’m still tempted to spend! Your budget is strict. You’ve tried to convince yourself you’ll never spend money on restaurants, but you keep setting yourself up for failure and saying yes when your BFF wants to grab a bite. You’re human, and your habits aren’t changing overnight.

Solution: Give yourself some breathing room. Cutting back is a noble goal, but don’t pretend you’re never going to go out again. Instead, cut back a little at a time. If you spend $500 every month and you want to spend $200, start small. Make it your goal to spend $400 instead. Once you nail that, try to spend $300, then nail that and aim for $200. Habits are hard to break, but you’ll have a lot more luck if you work with your behavior, rather than against it. Take it one step at a time so you’ll stick to the plan long term.

Problem: I have too many expenses and not enough income! You can’t seem to stick to your budget because your expenses are just too much. You make a decent living, but something always seems to come up and you’re already stretched so thin that you barely have money for your goals. And perhaps you live in a high-cost-of-living city, where it’s not easy to save.

Solution: You need a Lifestyle Deflation Plan. Often enough, the reason people can’t stick to a budget, even on a decent income, is that they’re overspending on stuff. It sounds harsh, but even if you’re not living lavishly, you might still be spending more than you can afford. It might be fancy groceries or an apartment that’s beyond your means right now. The solution comes down to priorities. Revisit the “Where Do I Cut Back?” pyramid earlier in this level and revisit the “Avoid at All Costs List” in Level Three. You can afford the life you want, but you have to prioritize what you want right now.

Problem: I’m done being frugal. My budget still feels like I’m depriving myself. You’re ready to give up on your budget because even though you know it’s designed to support your goal, you’re tired of cutting back on lattes and other small pleasures that help you get through the day. Honestly? You’re not even sure it’s worth it anymore.

Solution: Don’t sweat the small stuff. Focus on the big stuff instead. Sometimes we exhaust ourselves by cutting back on a bunch of small expenses when we could easily reduce our budget by focusing on the areas we spend on the most. This is usually housing, transportation, and food. If you move to a cheaper part of town and your rent is reduced by $300 a month, that’s a substantial savings every month. Yes, you have to move, and we all know moving sucks. But after the move, you’re done. You continue to save $300 every month. That’s a lot easier than trying to save $300 by cutting back on all the little stuff every month.

Problem: It’s taking forever to reach my goal. I don’t want to do it anymore. You’re ready to give up on your budget because your goal seems light-years away. You’re saving $3,000 for a trip but you won’t even be able to take it until a year and a half from now. That’s eons away, and when you think about it in those terms, you’re not even excited anymore.

Solution: Set smaller goals and reminders. Make your goals feel closer and more attainable. The most effective way to do this is to set smaller milestones for your goals. For example, if your goal is to save $5,000 a year, break it down this way: “I want to save $400 a month.” Or even “I want to save $100 a week.” This way, your abstract future goal becomes a little more present and tangible. Don’t forget to celebrate, too! You like cake? Allow yourself to enjoy a big slice of one from your favorite bakery when you reach a savings goal. Yes, it costs money, money you could be saving, but it also gives you an incentive to avoid giving up.

Sticking to your budget is really about sticking with your goal. If your goal is out of sight, it’s going to be out of mind, too. So make your goal part of your day-to-day life with a visual reminder of it. Tape your goal to your credit cards. Send yourself e-mail reminders of why that goal is important to you. It’s amazing how well you’ll stick to something if you have someone holding you accountable, too.

I hate jogging more than anything, and always have. But every now and then, I’d vow to start getting in shape and jogging around the block once a week. I’d pump myself up, put on my running shoes, and that first week, I’d be out there, pounding the pavement and sweating like a hog. And then I’d never jog again. After telling my friend Dara about this problem, she suggested we start jogging together, and suddenly, I never missed a week. It helps to surround yourself with like-minded people. They might support your goal, they might have similar goals, or they might just remind you of your goal. Don’t feel comfortable discussing money with your friends? Check out personal finance blogs and online forums. They can be great communities of like-minded, money-management people.

You just built a plan to make your

money work for you instead of the other way around. Give

yourself a high five (so, clap, I guess?) and advance to the next

round. Here are a few extra tips to take with you:

You just built a plan to make your

money work for you instead of the other way around. Give

yourself a high five (so, clap, I guess?) and advance to the next

round. Here are a few extra tips to take with you:

Your budget doesn’t have to be

perfect. In fact, it won’t be. Your budget is a plan for your

spending. If the plan goes off course, recalibrate.

Your budget doesn’t have to be

perfect. In fact, it won’t be. Your budget is a plan for your

spending. If the plan goes off course, recalibrate.

Your budget requires maintenance.

By all means, pay yourself first and automate your bills, but don’t

forget: budget should be a verb, not a noun. It’s a habit. Check in

on it periodically and keep tabs on your spending.

Your budget requires maintenance.

By all means, pay yourself first and automate your bills, but don’t

forget: budget should be a verb, not a noun. It’s a habit. Check in

on it periodically and keep tabs on your spending.

GET MONEY BASIC BUDGETING TEMPLATE

You can also find this template at www.TheGetMoneyBook.com.

MONTHLY INCOME (after taxes):$______________________

Basic Living Expenses (rent, groceries, electric bill)

Cost

TOTAL:

DISCRETIONARY INCOME (Total expenses minus income):$______________________

(This is the amount you have for goals and “wants.”)

Financial Goals (debt payoff, emergency savings, retirement)

Cost:

TOTAL:

AMOUNT LEFT OVER FOR “WANTS” (Total expenses minus income) $______________________

(This is the amount you’re free to spend as you wish.)

Wants (restaurants, clothes, travel, gadgets)

Cost

TOTAL: