LEVEL TWO

Power Up with an “Oh, Crap, I Didn’t See That Coming” Fund

You know the feeling. Rent is almost due and your bills are almost due, but you have a paycheck coming right before all these payments are scheduled. Everything looks okay. For this month, at least, you can rest easy, because it looks like everything is going to work out just fine.

And then your car dies.

Oh, crap, you think. I didn’t see that coming. Now what? We’ve all been there, which is why we all need an Oh Crap Fund, better known as an emergency fund. An emergency fund is a stash of cash you keep on hand in case of (you guessed it) an emergency: your car breaks down, your cat needs surgery, you need surgery. In case of the worst, the emergency fund keeps you from destroying your budget, stressing over money, and derailing your financial goals.

Oh yeah? you might be thinking. You want me to save extra cash for an emergency? Sure! While I’m at it, let me just pull some cash out of the air and put it in my unicorn fund, too.

The problem with generic money advice like “save for an emergency” is that money is a limited resource for most of us. For some of us, it’s an incredibly limited resource. The idea of keeping extra cash on hand seems almost like a luxury. It’s money, and it’s just sitting there! You could use it for so many other things you want and need: new furniture, a trip to Venice, or, I don’t know, rent? An emergency fund seems like something only wealthy people can afford, but ironically, when you’re struggling to make ends meet, you need an emergency fund more than anyone else.

HOW YOUR EMERGENCY FUND GIVES YOU POWER

As unnecessary and as much like overkill as it may seem, an emergency fund is a crucial first step toward getting your money in order for one simple reason: it empowers you. When you take the time to build this safety net, you flip the script. Instead of the broke, always-struggling-to-get-by financial stereotype you’re used to living, you’re now prepared, secure, and one step closer to being in control of your financial situation. You start to look at money differently, too. Instead of being derailed by a setback, you’re now in charge, and that feeling of empowerment will give you the motivation to keep working toward your goal. It’s a complete mind-set shift. And when it comes to personal finance, mind-set is everything.

When I had student loan debt, I thought the idea of an emergency fund was completely ridiculous. Again, why bother saving money when I was in debt? It seemed counterproductive and pointless. And then, just like the aforementioned example, my car broke down. With limited options, I decided to pay for the repairs with a credit card and pay off the debt later. As a result, I racked up a bunch of interest, struggled to make my student loan minimum payment, and, eventually, had to move back into my childhood home. It’s hard to feel like you have power over anything when you’re juggling multiple debts and living in a room with a Jonathan Taylor Thomas poster your twelve-year-old self taped to the door.

An Oh Crap Fund completely changed my relationship with money. Yes, it took some time to build. But once I had that safety net in place, a huge amount of stress and fear I had about my finances disappeared. When an emergency popped up, I no longer had to make desperate, bad decisions that put me in vulnerable positions. I had a cushion, a buffer between my own money situation and financial distress.

Speaking of empowerment, an emergency fund also gives you the power to do things you might be afraid of doing. Let’s say you have the world’s worst job and you’d really like to quit, but you don’t want to risk being unemployed because you have no idea how you would make ends meet if you couldn’t find something else soon.

With an emergency fund, that risk becomes slightly less risky. You might still be afraid to take the leap, but now you have less reason to be afraid. Emergency funds work with your psychology rather than against it, and personal finance isn’t just about math, it’s about making the math work for you.

PRO TALK: Paulette Perhach, author of The F*ck Off Fund

HOW DOES AN EMERGENCY FUND GIVE YOU POWER?

I grew up broke, so I never really felt the power of having extra money when you need it. Broke people live in the constant flush between stuck and splurge.

Now that I’ve saved a few thousand dollars, I understand the immense relief of having it just in case. Money solves problems a thousand different ways. If you’re emergency-level overbooked, you can buy more time by hiring someone to offload tasks to. If a member of your family across the country has a crisis, you can buy proximity by getting a flight that day. If a tree falls on your house, you can buy space in a hotel.

You can flip it around to opportunity as well. Maybe you get your dream job offer, but you need clothes for the interview or equipment to accept a gig. You can buy the freedom to take advantage of opportunities that may never come around again.

You don’t know what you need an emergency fund for until the emergency comes up. I think that’s why we humans are bad at saving them. They’re abstract. By the time they become visceral and immediate, it’s too late.

HOW BIG SHOULD YOUR FUND BE?

Now that you know what an emergency fund can do for you, it’s time to talk numbers. Exactly how much do you need in this fund?

Most personal finance experts recommend a whopping three to six months’ worth of basic living expenses. The reasoning is that, in the worst-case scenario—let’s say you lose your job—you’ll be able to pay your bills for the next several months. But if you’re struggling to make ends meet, six months’ worth of expenses puts you back in unicorn territory. When you can barely make ends meet, saving $10,000 probably seems right up there with visiting Narnia or meeting Frank Sinatra. You simply don’t see how it’s possible, and it seems pointless to even try.

So forget that guideline and start with a smaller goal instead. When I finally decided to start saving for an emergency, my goal was nowhere near six months’ worth of expenses (or even three). I just wanted to save $1,000. If, for you, that still seems insurmountable, you could start even smaller. Make it your goal to save $500. Or $200. Even a hundred bucks can make a big difference in an emergency, and you can likely reach this goal in a reasonable amount of time. Sure, you’ll eventually want to build a bigger cushion so you can cover a long-term emergency, like a job loss, but for now, start small.

Once you have a goal in mind, break it up even more. Focus on saving even smaller amounts, like $40 a week. After all, $40 is lot more digestible than $400 and a hell of a lot easier than saving $4,000. But at the rate of a mere $40 a week, you’ll have almost $350 saved in two months. That’s not bad. From there, $500 doesn’t seem nearly as overwhelming as it does when you’re starting from zero.

It may also help to save at a gradually increasing pace each month. This way, instead of saving $100 a week, you can start by saving $25 a week, which should be fairly painless, then increase your amount to $50 the next week, and $75 the next week, and so on. This gives you time to get used to the new savings goal, find areas to cut back on, and avoid “budget shock” (the phenomenon in which you take your budget from zero to sixty, only to fail miserably).

ASSIGNMENT: Pick a Plan

Let’s get started on this whole emergency fund thing. Pick one of the following plans to stick with for the next four to six weeks. Mark your progress each week as you go.

Plan A: Four Weeks to $250

Week 1: Save $25

Week 2: Save $50, for a total of $75

Week 3: Save $75, for a total of $150

Week 4: Save $100, for a total of $250

$250 goal met!

Plan B: Six Weeks to $500

Week 1: Save $40

Week 2: Save $50, for a total of $90

Week 3: Save $75, for a total of $165

Week 4: Save $90, for a total of $255

Week 5: Save $115, for a total of $370

Week 6: Save $130, for a total of $500

$500 goal met!

Plan C: Eight Weeks to $1,000

Week 1: Save $50

Week 2: Save $75, for a total of $125

Week 3: Save $100, for a total of $225

Week 4: Save $125, for a total of $350

Week 5: Save $150, for a total of $500

Week 6: Save $150, for a total of $650

Week 7: Save $150, for a total of $800

Week 8: Save $200, for a total of $1,000

$1,000 goal met!

If you’re starting your emergency fund from scratch, pick a plan before you move on to the next level. Each of the three plans above give you specific, time-based goals that are designed to be realistic for your budget. Yes, $100 might be a lot to save every week, but with these plans, you don’t have to save that much every week. You will gradually start saving more and more until you reach your goal.

Considering your budget and your income, which plan works best for you? ______________________________

Excellent! This week, your goal is to save anywhere from $25 to $50, depending on which plan you chose. Take it one week at a time. Bookmark here and set a reminder to check back here each week until you’ve reached your savings goal.

WHERE TO STASH YOUR EMERGENCY FUND

Now that you have a plan to save, the next question is, where do you save? Sure, you could just store the cash in your checking account, but odds are, you’ll find something to spend it on if the money is that easy to access. As much willpower as you may have, you’ll be in an even better position if you avoid testing your willpower in the first place. In other words, store your emergency fund in a separate savings account.

You can take this advice a step further and store it in a savings account at a completely separate bank. This way, your checking and savings accounts aren’t directly linked, which gives you yet another buffer against any spending temptations or budget mishaps. Let’s say you’re close to overspending on restaurants one month and your checking account is linked to your savings. It’s easier to keep spending when you know that money is just sitting there, waiting to cover you and your sushi craving. When that money is stashed in an entirely different account, though, you’re forced to think twice about how badly you want salmon sashimi. If you’re especially prone to spending temptations, it might be smart to completely sever ties between your emergency fund and your regular spending account by keeping them at separate banks. On the other hand, there are drawbacks to separating this much. Namely, if your budget is stretched thin and you don’t have enough to cover your bills, you miss out on the overdraft protection you’d get with a linked savings account. One workaround might be to keep a small buffer in your checking account, but then you run into the same problem: the temptation to spend that money. If you don’t think you’ll dip into your savings, go ahead and keep it linked to your checking account.

To sum it all up: It’s best to store your emergency fund in a traditional savings account where you can easily access it in case of emergency. Whether or not you link it to your checking account is up to you. The point is just to have money on hand in case life throws you some dirty, rotten lemons—and this brings up another important point. What exactly counts as an emergency?

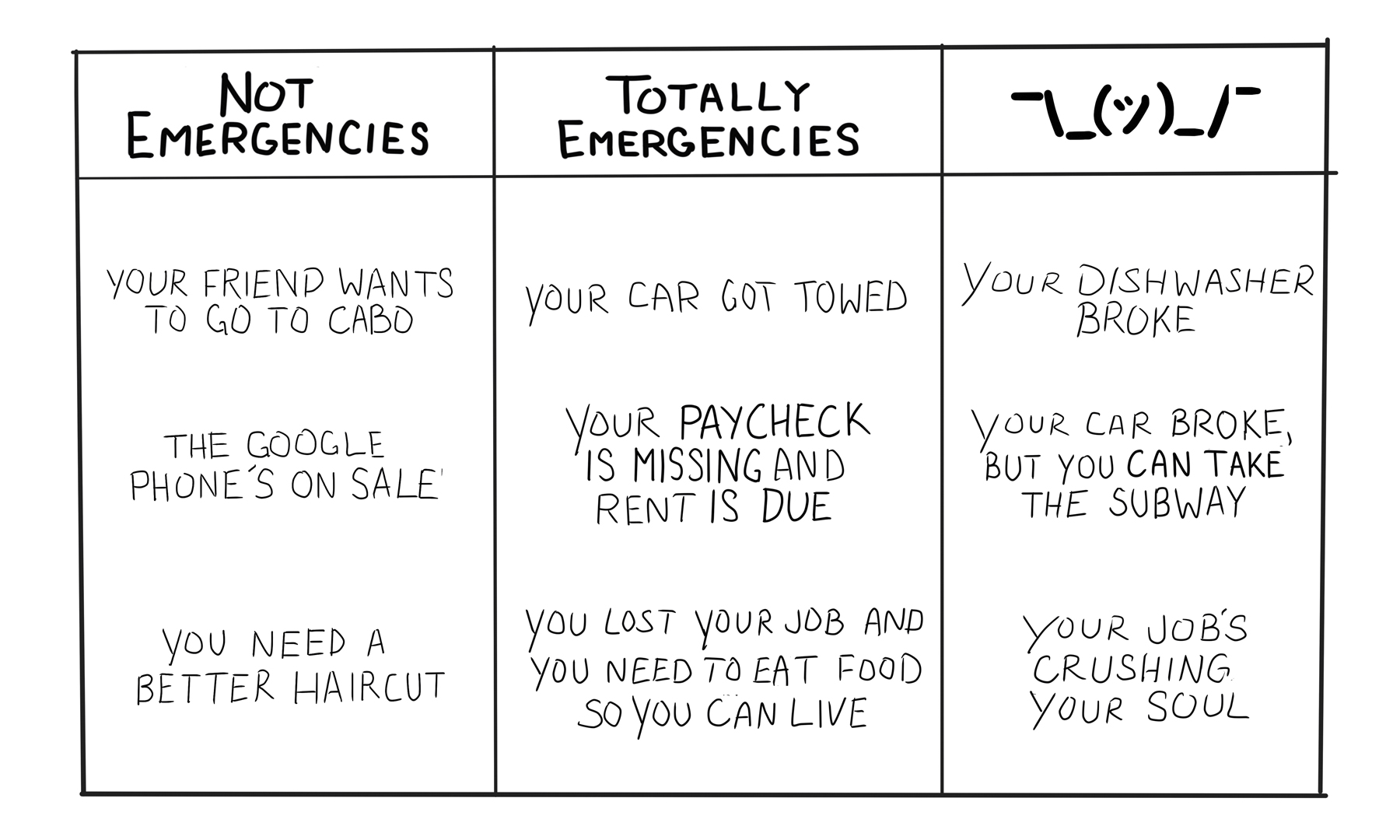

WHEN TO USE YOUR EMERGENCY FUND

Some hazards, like a broken arm or a burst pipe, are obvious emergencies. Other “emergencies” might be less obvious. Generally, a financial emergency is an unplanned expense that will cost more if you ignore it. Holidays, birthdays, and dental checkups are not emergencies. You can, and should, plan for all of those expenses when you budget.

When the expense is a financial emergency, you typically don’t see it coming: a job loss, a trip to the ER, a car accident. Often, emergencies are also more expensive if you ignore them; a burst pipe is a good example of that. Health is another important factor for deciding whether something is an emergency. If your health or the health of someone you love is at stake, that’s what your emergency fund is there to cover.

While some things are so obviously not emergencies, there’s still a gray area, like that aforementioned terrible job, for instance. At what point does a really bad job become an emergency? If it’s driving you to the brink of insanity and making your whole life miserable, it probably feels like you’re in emergency mode. Some would say it could be an emergency, and you should use your savings to look for another job. Others would disagree.

At the end of the day, everyone’s situation is different and you have to do what works for you. So instead of telling you what is and isn’t an emergency in your own life, I’ll urge you to work through this gray area and get specific about what you consider a true emergency. Here are a few questions you should ask with “iffy” emergencies:

Can I save up for this? Is it possible to save the cash for this expense in a reasonable amount of time?

Is there an alternative? For example, if your car breaks down, can you take public transportation while you save up for the repair?

Will it cost you more to postpone paying for the emergency? For example, if you need dental work, will it be more expensive if you put it off until you save up for it?

These are just a few questions to point you in the right direction. Keep in mind, if you’re tapping your emergency fund regularly, something is wrong. Unless you have the worst luck ever, emergencies should not be regular occurrences. If unexpected expenses “pop up” every month, you should start expecting them—and create an “Oh Crap” category in your budget. You’ll learn more about that in Level Four.

Now that you’ve established a plan to build your emergency fund, it’s time to put that plan into action. The rest of the levels in Stage One will show you how to do just that. In Level Four, you’ll learn how to build a budget that supports your savings efforts. In Level Three, you’ll learn how to save money on just about everything so that you actually have the cash to stash in your emergency fund.

Nicely done, my friend. You’ve

taken a major first step in taking control of your finances:

building a safety net. It’s one small step in this book, but a

big-ass leap for making your money work for you. Some extra tips

for keeping your fund intact:

Nicely done, my friend. You’ve

taken a major first step in taking control of your finances:

building a safety net. It’s one small step in this book, but a

big-ass leap for making your money work for you. Some extra tips

for keeping your fund intact:

• Don’t use the same account you use for emergency savings to save for other goals. Keep savings accounts separate. This ensures you only use your emergency fund for emergencies, but having multiple savings accounts may actually inspire you to save more, too.

• Many people skimp on things like car insurance when they’re on a tight budget. This can make an emergency situation much more dire. Prevent emergencies from happening in the first place by making sure you’re covered.